To ensure sustainable growth, businesses need to track a variety of key metrics that provide insights into their financial health, operational efficiency, and customer satisfaction. Here are some essential metrics every business should monitor:

1. Revenue Metrics

- Total Revenue: The total income generated from sales. Tracking this helps businesses understand their overall market performance.

- Revenue Growth Rate: Measures the rate at which a company’s revenue is increasing or decreasing over time. It’s crucial for assessing growth and setting future sales targets.

- Recurring Revenue: For businesses with subscription models, monitoring Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR) is important for forecasting future income.

2. Profitability Metrics

- Gross Profit Margin: The percentage of revenue that exceeds the cost of goods sold (COGS). It indicates how well a company is managing its production costs relative to sales.

- Net Profit Margin: The percentage of revenue left after all expenses (operating, taxes, interest) have been deducted. It reflects the overall profitability of a business.

- Operating Margin: Operating income as a percentage of revenue, which measures the efficiency of a company’s core business activities.

3. Customer Metrics

- Customer Acquisition Cost (CAC): The cost associated with acquiring a new customer. Lowering CAC is crucial for improving profitability.

- Customer Lifetime Value (CLV): The total revenue a business can reasonably expect from a single customer account over time. A higher CLV indicates more profitable customer relationships.

- Customer Retention Rate: The percentage of customers a company retains over a given period. A high retention rate often correlates with customer satisfaction and loyalty.

- Net Promoter Score (NPS): A measure of customer satisfaction and loyalty based on how likely customers are to recommend the business to others.

4. Operational Metrics

- Inventory Turnover Ratio: A measure of how often inventory is sold and replaced over a period. A higher ratio indicates efficient inventory management.

- Days Sales Outstanding (DSO): The average number of days it takes to collect payment after a sale. Lower DSO indicates faster cash flow and efficient credit management.

- Employee Productivity: Metrics such as revenue per employee or output per hour worked help assess how effectively a business utilizes its workforce.

5. Financial Health Metrics

- Cash Flow: Monitoring cash flow from operating activities is critical for understanding the liquidity and financial health of a business.

- Current Ratio: A liquidity ratio that measures a company’s ability to cover its short-term obligations with its short-term assets. A ratio above 1 indicates good financial health.

- Debt-to-Equity Ratio: Indicates the relative proportion of shareholders’ equity and debt used to finance a company’s assets. A lower ratio suggests a more financially stable business.

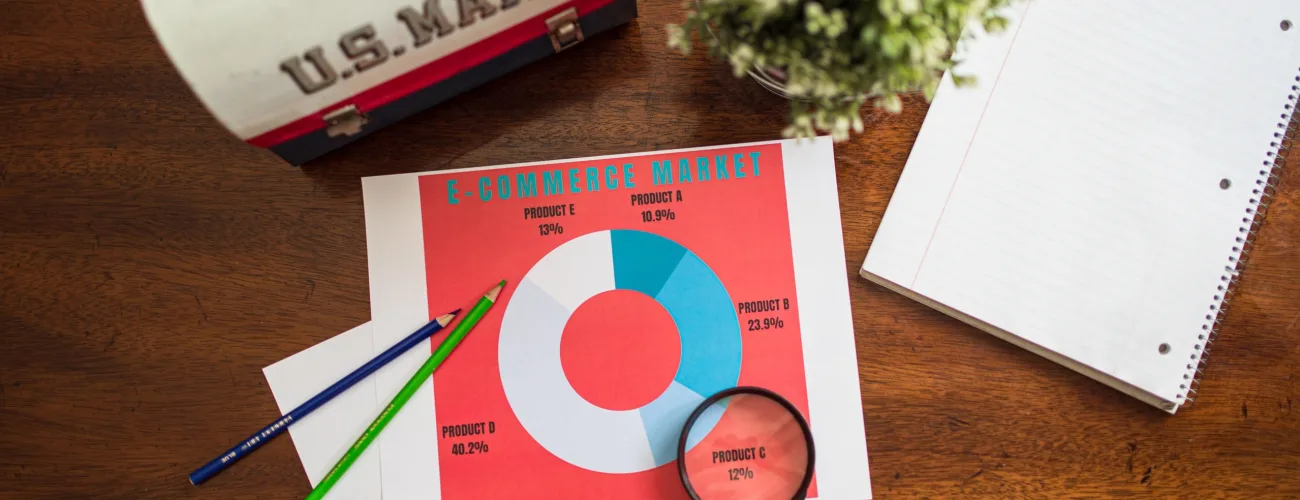

6. Market and Growth Metrics

- Market Share: The percentage of an industry or market’s total sales that is earned by a particular company. Increasing market share indicates growth and competitive strength.

- Growth Rate in Key Segments: Tracking growth in specific product lines or geographic markets helps businesses identify opportunities and allocate resources more effectively.

7. Digital and Online Metrics

- Website Traffic and Conversion Rates: Metrics like unique visitors, page views, and conversion rates are vital for businesses with an online presence.

- Customer Engagement Metrics: Social media engagement, email open rates, and other digital interaction metrics help gauge customer interest and engagement.

By regularly tracking these key metrics, businesses can gain valuable insights into their performance, make informed decisions, and foster sustainable growth.